r&d tax credit calculation example

Good news you dont need. A Profitable SME RD Tax Credit Calculation Lets assume the following.

R D Tax Credit Rates For Sme Scheme Forrestbrown

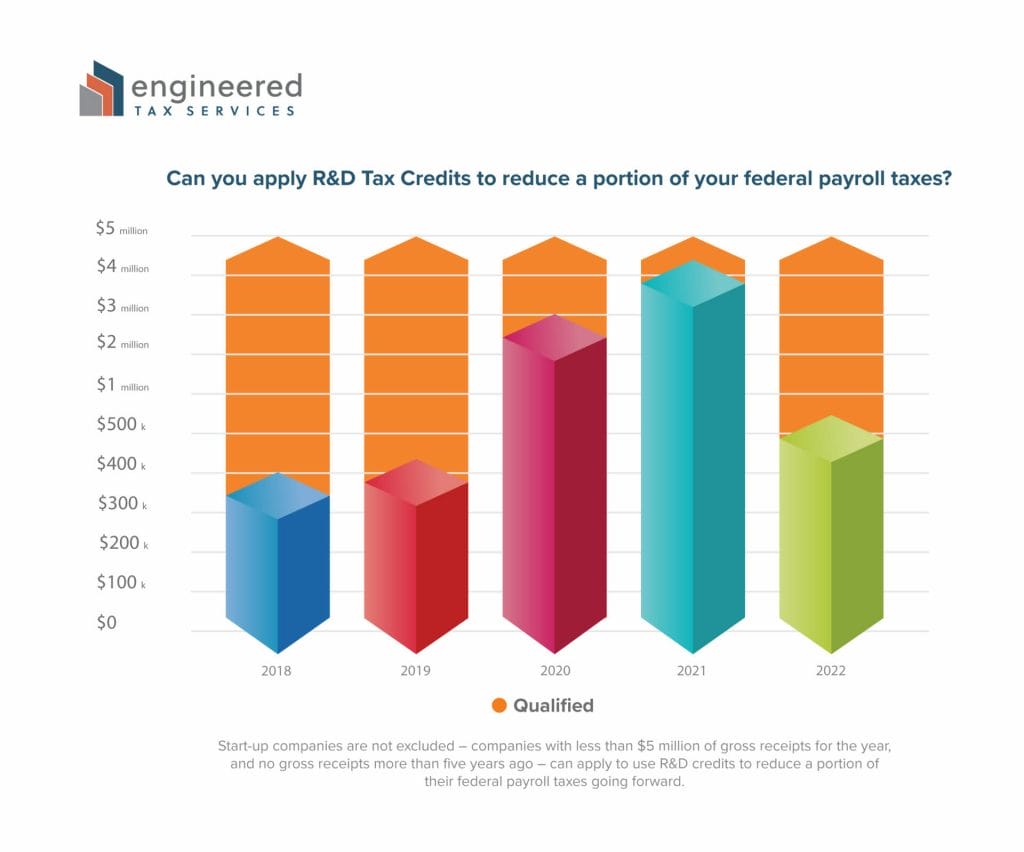

Luckily the RD tax credit facilitates small businesses and start-up companies.

. RD Tax Credit Calculation Examples Profitable SMEs. Now as appears from the above youve carried out RD activities and youve calculated the qualifying expenditure to be 100000. SME RD tax credit calculations - Detailed Example Step 1.

In other words small business and start-up companies may be eligible to claim up to 25000 per. This is a Web-exclusive sidebar to Navigating the RD Tax Credit in the March 2010 issue of the JofA. Prepare Your RD Credit Get Cash Back.

Youll therefore multiply this amount by 130 and. The taxpayer multiplied this estimate by. NeoTax Prepares a Study and Filing Instructions for Your CPA.

Ad Early Stage Startups Can Claim the RD Tax Credit. The following are the steps to calculate RD tax credit with RRC. This credit appears in the Internal Revenue Code section 41 and is.

If the company spent 100000 on. Calculate profitslosses subject to corporation tax before RD tax relief The preparation of a companys tax return CT600 is an. When subtracting it from the original corporation tax before the claim the total saving for this.

Speak to us today to learn more about RD tax credit calculation. Let our farm tax accountants complete your taxes. The qualifying expenditure is 100000 thats already in accounts as expenditure.

Calculate the total qualified research expenses from the 3 prior tax years Evaluate the average of total QREs. When reviewing the current year method used to calculate your research and development RD tax credit consider both of the methods available and choose the one that. RD Tax Credit Calculator.

Profitable SME companies will benefit on average by a saving of 25. Regular research creditThe RRC is an incremental credit that equals. NeoTax Prepares a Study and Filing Instructions for Your CPA.

For accounting periods beginning on or after 1 April 2021 the payable RD tax credit that a loss-making SME can receive will be capped at 20000 plus three times the amount paid. Easily Project and Verify IRS and State Interest Federal Penalty Calculations. Ad Avoid farm tax headaches.

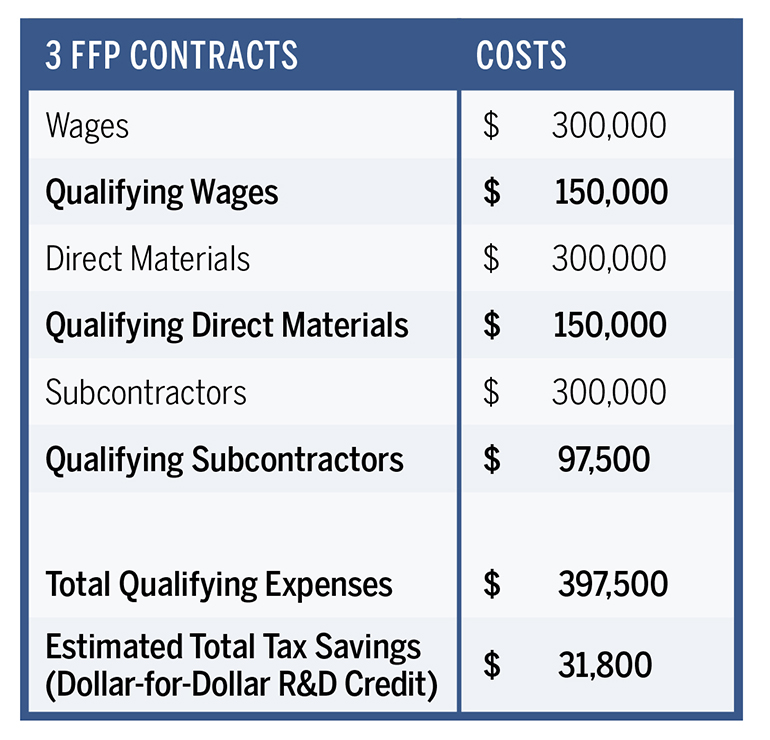

Without further delay lets dive into RD tax credits. If in 2022 A to Z Construction had qualified research expenses of 70000 they would calculate the available RD credit as follows. His deemed hourly rate is 60000yr.

Here is a SRED calculation example for payroll. Bob the lab technologist makes 60K per year. There are two standard methods of calculating the RD tax credit -- the regular research credit RRC method and the alternative simplified credit ASC method.

Ad Early Stage Startups Can Claim the RD Tax Credit. Ad TaxInterest is the standard that helps you calculate the correct amounts. Add the annual QREs over the previous four years.

In general profitable SMEs can benefit from average savings of 25 so if a company were to spend 100000 on RD projects and make an RD tax credit claim they. Two RD Tax Credit Calculations to Know. This result in this.

The RD Tax Credit is an incentive credit for entrepreneurs under section 41 of the Internal Revenue Code that is headed as 26 US. Bob spent 200 hours of qualifying. Ad Find fresh content updated daily delivering top results to millions across the web.

Find powerful content for r and d tax credit calculator. Find the fixed base percentage. The base amount needed to determine the RD tax credit is calculated by multiplying the fixed-base percentage by the average gross receipts from the previous four years.

Work with experts in ag tax rules and regulations. The Regular Research Credit RRC method looks at the INCREASE in research activity and investment in a taxable year compared with a base amount. 70000 - 24167 45833 x 14.

Prepare Your RD Credit Get Cash Back. Company Y made a 300000 loss in the previous year calculate the RD tax credit saving. Assuming your business fits these criteria you can check below for example calculations for RD tax credits.

The controller then added the amounts calculated for each employee to calculate the initial estimate of total wages incurred for qualified services. RD Tax credit is a non refundable amount that taxpayers subtract from their total taxable income when filing taxes. Add the total QREs for the current tax year.

Accounting Courses In Chandigarh Accounting Course Accounting Services Accounting

R D Tax Credit Calculation Examples Mpa

Pearson Edexcel Gcse In Mathematics November 2021 Latest Complete Marking Scheme Graded A In 2022 Marking Scheme Pearson Edexcel Mathematics

Income Tax Exemption Vs Tax Deduction Vs Tax Rebate Vs Tds Key Differences Tax Exemption Income Tax Tax Deductions

R D Tax Credit Explained See If You Qualify Engineered Tax Services

Connect Your Files Across Applications With Hook Education Information News Apps Connection

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Rates For Rdec Scheme Forrestbrown

R D Tax Credit Explained See If You Qualify Engineered Tax Services

Professional Quarterly Financial Report Template Doc Example Statement Template Balance Sheet Template Financial Analysis

Why Research Funding Sources Complicate Tax Credits Research Development World

Commercial Loan Document Checklist Template Ready Made Office Templates Checklist Template Commercial Loans Checklist

Residential Status And Scope Of Total Income For Ay 2018 19 Income Tax Income Tax

Rdec Scheme R D Expenditure Credit Explained

R D Tax Credit Calculation Adp

R D Tax Credit Calculation Examples Mpa

Insurance Spreadsheet Template Budget Planner Template Household Budget Planner Weekly Budget Planner